Longer solar lifespans test analytics, repowering gains

Longer lifespan assumptions are increasing the importance of predictive technology and repowering strategies, experts told Reuters Events.

Related Articles

Increasing lifespans for PV plants are placing greater pressure on long-term operations and maintenance (O&M) efficiency.

Longer lifespans allow operators to spread costs over a longer operating period and compete for lower-priced power purchase agreements (PPAs). The average life expectancy of US utility-scale PV projects rose to 32.5 years in 2019, compared with 21.5 years in 2007, according to a recent survey by the Lawrence Berkeley National Laboratory (Berkeley Lab).

Longer lifespans increase project exposure to merchant wholesale prices that are typically lower than PPA contracts.

Average O&M costs have fallen, but costs rise as components age during the merchant tail period. This makes long-term O&M assumptions, including major component replacement, critical to project risk.

Accelerated lifetime testing helps to inform financial models and growing operational data will spur new learnings on replacement costs.

Lenders are particularly keen to minimize uncertainty during the lower price merchant tail period, Bjarne Sonderskov, Head of Technical Operations at Danish renewable energy investor Obton, told Reuters Events.

“Cost of capital is crucial to the investment and that’s also why we look to improve the O&M by predicting failure to any component," he said.

Data grab

Growing O&M learnings and competition between suppliers have reduced prices.

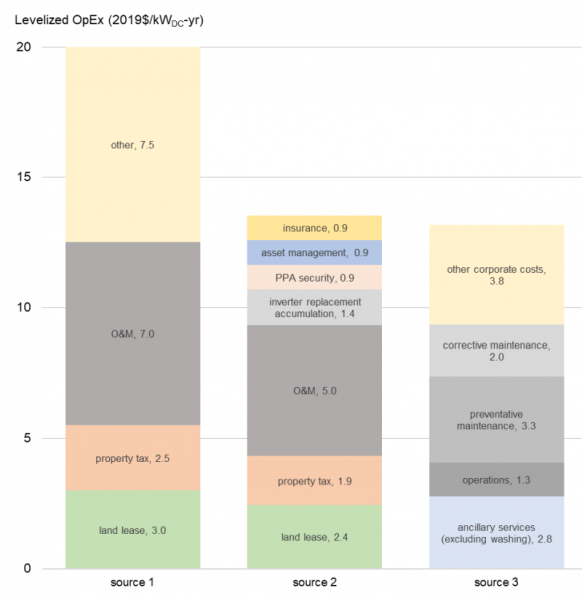

US O&M costs were estimated at between $5,000 and $8,000/MW/yr in 2019, the Berkeley Lab found. In 2018, the National Renewable Energy Laboratory (NREL) pegged O&M costs without inverter replacement at around $9,000-10,000/MW/yr and prices including inverters at $13,000-14,000/MW/yr.

Global O&M spending is set to soar in the coming years as more capacity comes online. Annual global spending on solar operations and maintenance (O&M) is forecast to double to $9.4 billion by 2025, Wood Mackenzie Power and Renewables said in a recent report.

US solar opex estimates in 2019

(Click image to enlarge)

Source: Berkeley Lab's 'Benchmarking Utility-Scale PV Operational Expenses and Project Lifetimes' report (June 2020).

Wind O&M has advanced faster than in the solar sector, spurred by higher maintenance costs. Many large wind operators have deployed predictive and preventative maintenance strategies to avoid major equipment failure and minimize downtime. Wind turbine suppliers have expanded O&M services and digital products to gain a share of the growing O&M market.

Larger solar operators are also implementing plant monitoring and data analytics technologies, looking to maximize economies of scale. Renewables developer Invenergy is developing in-house analytics to support rapid growth in the services sector. Solar operators like Invenergy, Duke Energy and Enel Green Power are deploying drones while some groups are testing automated cleaning technology. Gains from these technologies will increase as data pools grow.

Preventative maintenance will be key to reducing labour costs and gaining a competitive edge, Sonderskov said.

It could be "three or four years" before PV faults can be accurately predicted, he warned.

Many solar operators are still not spending enough on O&M, Hugh Kuhn, Principal at Solar Advisory Services in California, told Reuters Events.

"Assets are simply not being cared for as they should be for a long life,” Kuhn said.

Relatively minor issues such as misalignment of trackers, suboptimal inverter function or faulty module connectors, can add up to unravel the financial model, he said.

Repowering risk

Replacement of major components such as inverters are a critical factor in lifespan modelling.

Rapid technology advances have prompted repowering with higher performance products far earlier than many expected.

“The most challenging aspects of greenfield project development reside in permitting, zoning, interconnection, and land acquisition, so repowering with new equipment can be a shrewder financial choice than developing an entirely new project," Tara Doyle, Chief Commercial Officer at PV Evolution Labs (PVEL), said.

Operators must take into account compatibility of components in repowering cost assumptions. For example, central inverters are now wired to 1,500V, compared with 600V ten years ago.

"15 years from now the inverters will not be anywhere close to being electrically compatible with inverters installed today," Kuhn said.

“The inverter manufacturers need to up their game by offering future-proofing solutions. Certain areas of industry standardization would be super helpful," he said.

As more PV and wind capacity comes online, repowering models must factor in additional technologies, such as energy storage, Kuhn said. PV plus storage facilities can access higher prices in wholesale markets and revenues from grid services.

Storage functionality significantly changes the revenue model, but operators can include this option in contract terms from the outset, he said.

Reporting by Neil Ford

Editing by Robin Sayles